ad valorem tax florida ballot

The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied. The ballot question asks St.

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Release surveillance video in.

. Ad Fill Sign Email FL DR-504 More Fillable Forms Register and Subscribe Now. Expand art music and physical education. The Duval County Public Schools Florida Ad Valorem Tax Measure is on the ballot as a referral in Duval County Public Schools on August 23 2022.

A Manatee County Economic Development Ad Valorem Tax Exemptions Referendum ballot question was narrowly approved on the June 18 2013 election ballot in Manatee County which is in Florida. The 2022 Florida Statutes. The district school board pursuant to resolution adopted at a regular meeting shall direct the county commissioners to call an election at which the electors within the school districts may approve an ad valorem tax millage as.

The School Board of Hillsborough County wants to levy an additional tax of ad valorem operating millage of 1 mil annually one dollar of tax for each 1000 of assessment from July 1 2023 through June 30 2027 to help recruit and retain highly qualified teachers and staff. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. 1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS.

The measure authorized the Board of County Commissioners to grant property tax exemptions to businesses that are developing and. WHEREAS the renewal of the one 1 mill ad valorem is not a new tax or a tax increase but a four 4 year extension of the current millage rate. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Lucie County voters if the Economic Development Ad Valorem Tax Abatement incentive should be authorized for another 10 years. A yes vote supports continuing the levying of an ad valorem tax at a rate of 1 per 1000 of assessed property value for four years 2023-2027 to pay school teachers and fund school programs.

Section 1961995 Florida Statutes requires that a referendum be held if. And expand workforce. Increase salaries to retain and recruit teachers and staff.

The Orange County Public Schools Florida Ad Valorem Tax Measure is on the ballot as a referral in Orange County Public Schools on August 23 2022. When casting their vote on the November 8 2022 ballot Cape Coral voters will be asked whether or not to approve the Economic Development Ad Valorem Tax Exemption. Expand art music and physical education.

191008 any applicable general laws of local application and a districts enabling legislationThe rate. The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice a year. And WHEREAS a renewal of the additional ad valorem millage for operating purposes will generate approximately 818 million through the four 4 year period beginning in fiscal year 2023-24 and.

While everyone wants what is. Lucie County Board of County Commissioners authorized the placement of the Economic Development Ad Valorem Tax Abatement on the primary ballot on Aug. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment.

In this presentation we offer some considerations to ponder before voting for the Martin County School Board ad valorem tax extension. 101173 District millage elections. Ad Download Or Email FL DR-504 More Fillable Forms Register and Subscribe Now.

A yes vote supports levying an ad valorem tax of 1 mill 1 for every 1000 of assessed value to pay schoolteachers and fund public and charter school programs. Hillsborough County voters will have the opportunity to strengthen our schools and community by deciding on a one mil referendum in the primary election ballot on August 23 rd. This resolution will be on the primary ballot on August 23rd.

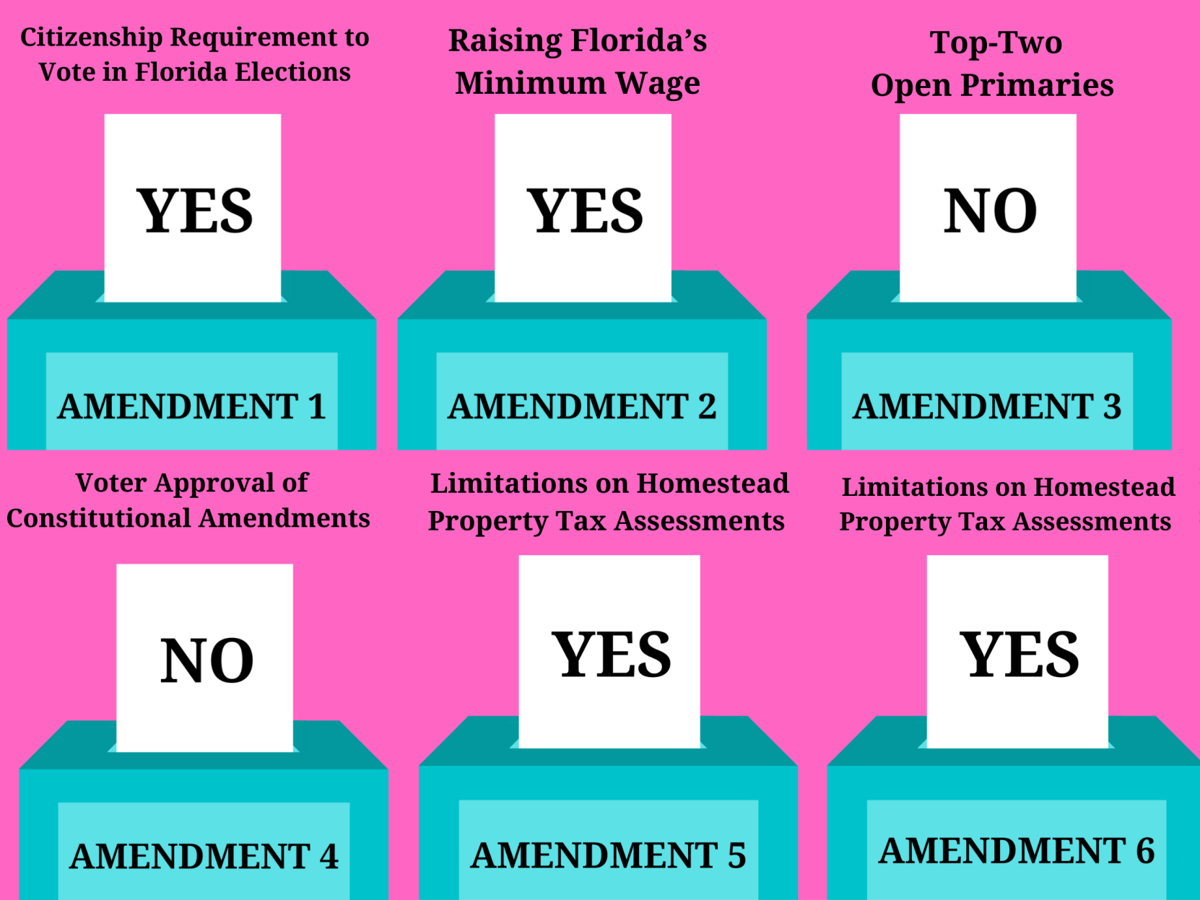

Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or beneficial title to and who permanently resides on the homestead property until he or she remarries or sells or otherwise disposes of the property. Manatee School Board Ad Valorem Tax Continuation Court. 1 The Board of County Commissioners or.

To Charter Schools pursuant to Florida Statute 101171. The Ad Valorem Tax Exemption is an economic development incentive tool made available to cities through the Florida Constitution that must be approved by the citys voters. The one mil referendum will.

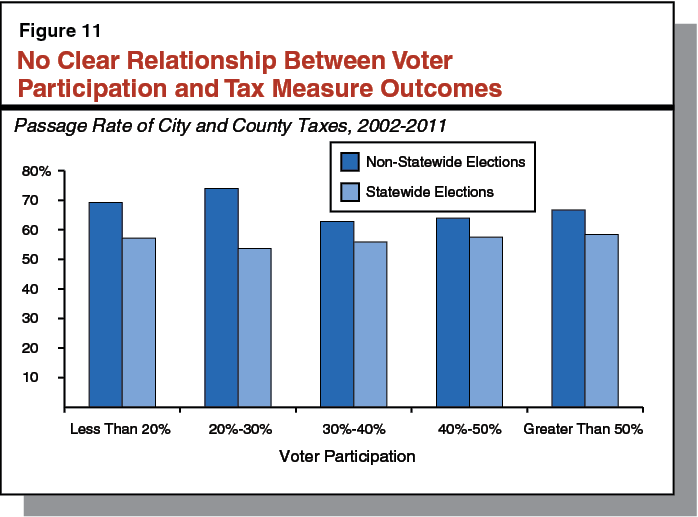

A Look At Voter Approval Requirements For Local Taxes

Roll Back Rate In Property Taxes Definitions And Explanations

Orange County Mayor Says Penny On The Dollar Sales Tax Will Solve Travel Woes

2022 State Tax Reform State Tax Relief Rebate Checks

What Is Escrow And How Does It Work Zillow

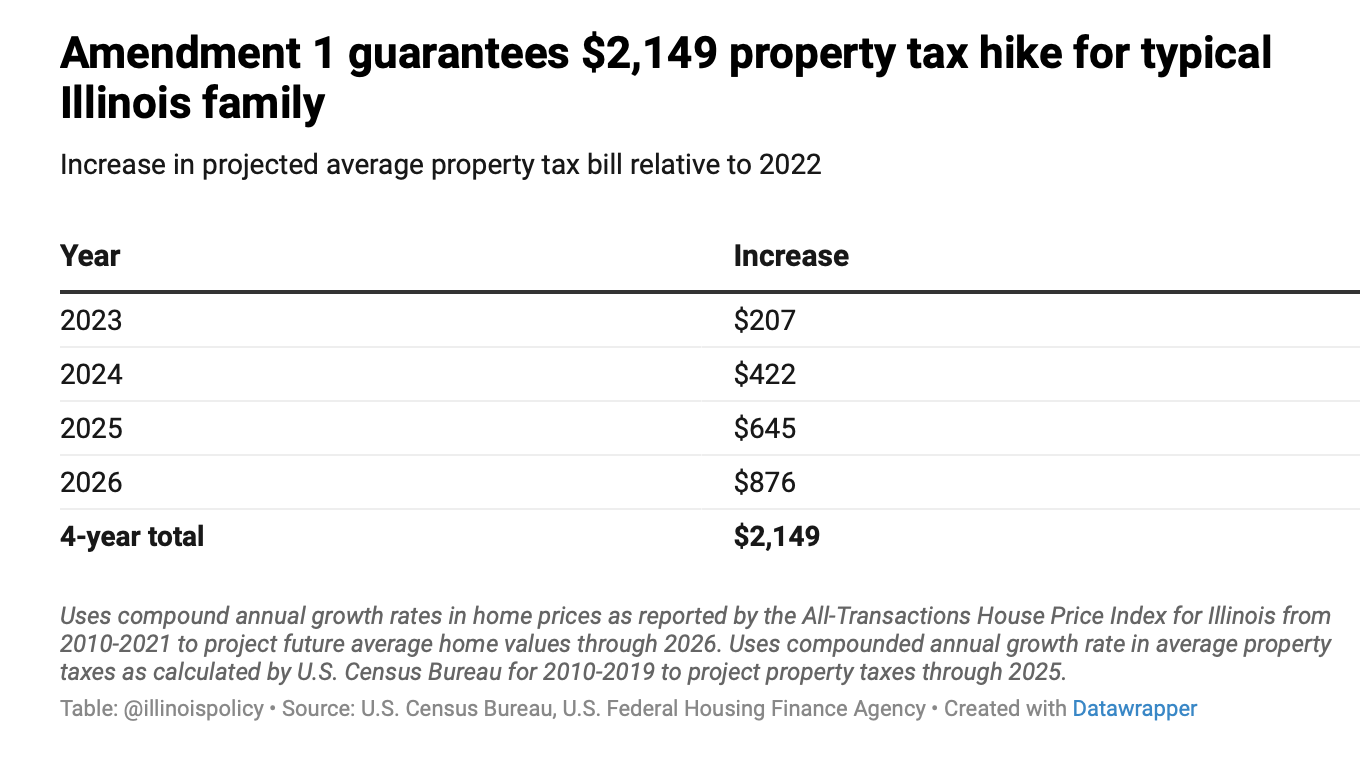

Amendment 1 Will Raise Your Property Taxes Here S How Cook County Record

Florida To Vote In November On Additional Property Tax Exemption For Certain Public Service Workers Ballotpedia News

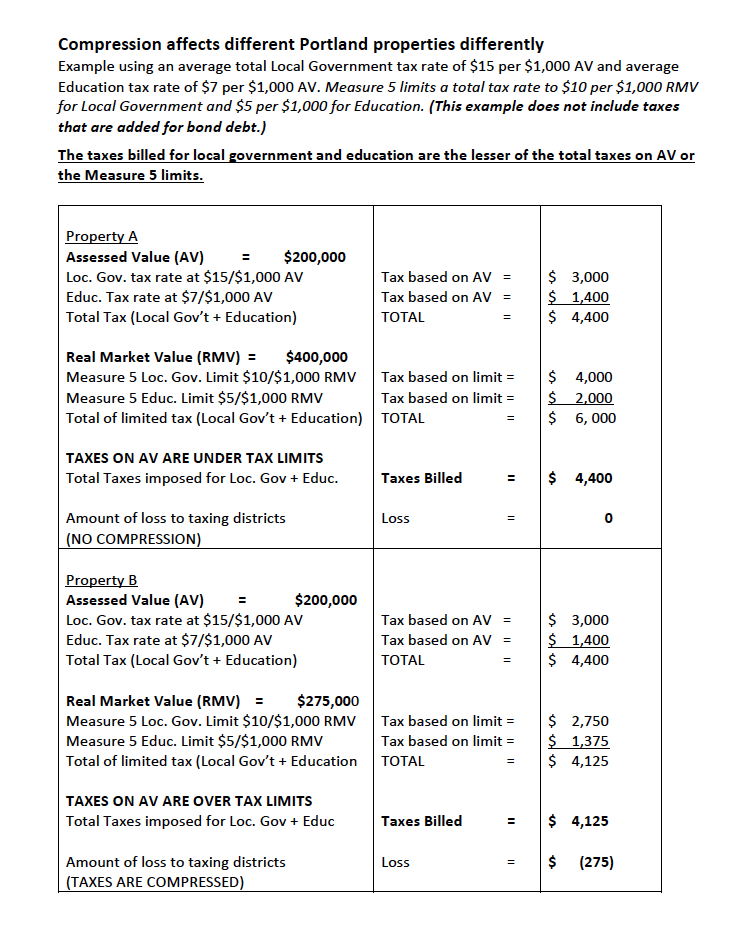

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

What Happens If Disney Loses Its Special Tax Status In Florida Cnn Video

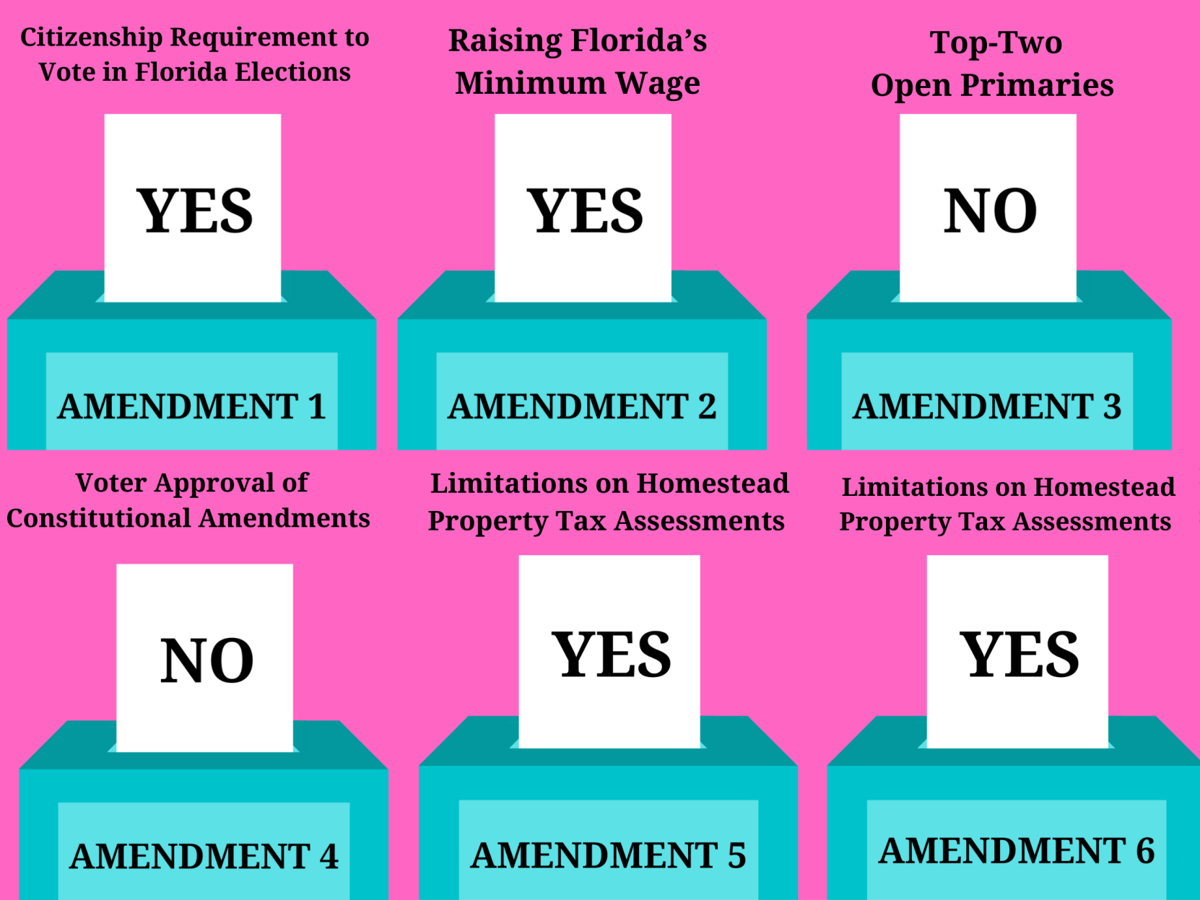

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

Understanding Your Vote Charlotte County Florida Weekly

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media